[Editor’s Note: today’s post is brought to you by guest blogger Bruce Buchanan, partner-in-charge of Immigration Practice, King & Ballow, LLP.]

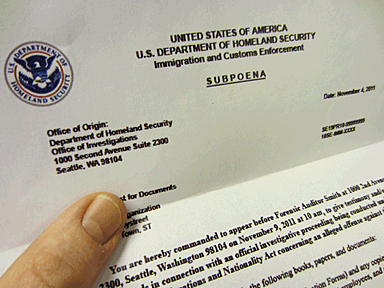

The U.S. Immigration and Customs Enforcement (ICE) issued Notices of Inspection (NOIs) to a number of employers on November 4, 2011. ICE will not release the number of NOIs, though it is believed to be about 500, or the names and locations of the businesses served with NOIs.

If your business was not targeted, count yourself lucky. If your business is served with a NOI, what should you do and what will happen during the inspection/investigation? Having represented clients in several ICE audits in past few years, here are my thoughts and insights.

If your business was not targeted, count yourself lucky. If your business is served with a NOI, what should you do and what will happen during the inspection/investigation? Having represented clients in several ICE audits in past few years, here are my thoughts and insights.

The NOI, which begins the ICE audit, is hand-delivered by an ICE agent of Homeland Security Inspections (HSI) to the business with a demand to inspect the I-9 records plus other employment-related records, such as payroll records, Social Security no-match letters, and a list of related companies. An employer has three days to comply with the NOI and should never provide the requested records upon initial receipt of the NOI. Sometimes ICE is willing to provide more than three days, if requested. An employer should contact their immigration counsel immediately upon being served with a NOI.

During the period between the delivery of the NOI and the deadline to provide the I-9s and other records, the employer and immigration counsel have the opportunity to determine if all of the employees’ I-9s are in order and, if not, make any necessary corrections/additions plus determine whether all employees have proper work authorization. During these three days, the employer’s HR manager (or whoever is in charge of immigration compliance for the employer) and immigration counsel will be spending a lot of time together. You should delegate the gathering of non-I-9 related records to another management official besides the one in charge of I-9s.

ICE will then return to the employer’s facility and remove the I-9s and related records or the employer and counsel must hand-deliver them to the local ICE office. (Employers should always make copies of the I-9s before providing ICE with the original I-9s.) At this point, the I-9s are sent to an ICE auditor.

Following the audit, which may take 2 to 18 months, ICE will provide a Notice of Suspect Documents, if applicable. This notice lists the names of all employees who could not be authenticated as having valid work authorization. At this point, the employer must give notice, in writing or verbal, to each affected employee and provide him or her with an opportunity to correct any mistakes, provide proper work authorization documents, or assert ICE made a mistake. The employer then provides such documents or assertions to ICE for their review. If an affected employee does not comply, the employer should terminate the employee.

Moreover, if the employer terminates the affected employees after providing notice and an opportunity to provide new documentation, an employer will not be subject to any fines or penalties for knowingly employing unauthorized workers – unless ICE discovers other evidence that the employer was aware of the affected employee’s illegal status. The fact that the employer hired an illegal alien, who provided a false A number, permanent resident card, work authorization document or Social Security number, is insufficient to prove the employer knowingly hired any illegal aliens.

Thereafter, ICE will provide the employer with a Notice of Technical or Procedural Failures and the underlying I-9s that have such errors. The employer has 10 days to correct the technical errors. If they are correctable and corrected, ICE will not issue any fines for these violations.

The final step in the audit is a “Notice of Intent to Fine” for substantive and uncorrected technical violations and/or for “knowingly employing” illegal aliens. Additionally, “knowingly employing” illegal aliens’ charges carry possible criminal indictments. An employer has 30 days to agree to pay the fines, reach a resolution on the amount of the fines or challenge the determination before the Office of Chief Administrative Hearing Officer (OCAHO).

Before ICE comes knocking at your door, your business should develop an immigration compliance program, which includes a self-audit of your I-9s, training for applicable management, draft and implement immigration compliance policies, including whether to use E-Verify.

Disclaimer: The content of this post does not constitute direct legal advice and is designed for informational purposes only. Information provided through this website should never replace the need for involving informed counsel on your employment and immigration issues.

To learn more about how I-9 Compliance Software can help you comply with Form I-9 and E-Verify requirements, click here.